Township Economies Driving

Development, Trade and Inclusive Growth

Almost half of Southern Africa’s urban population resides in townships and informal settlements, with this segment of the population representing a market worth hundreds of billions of Rands.

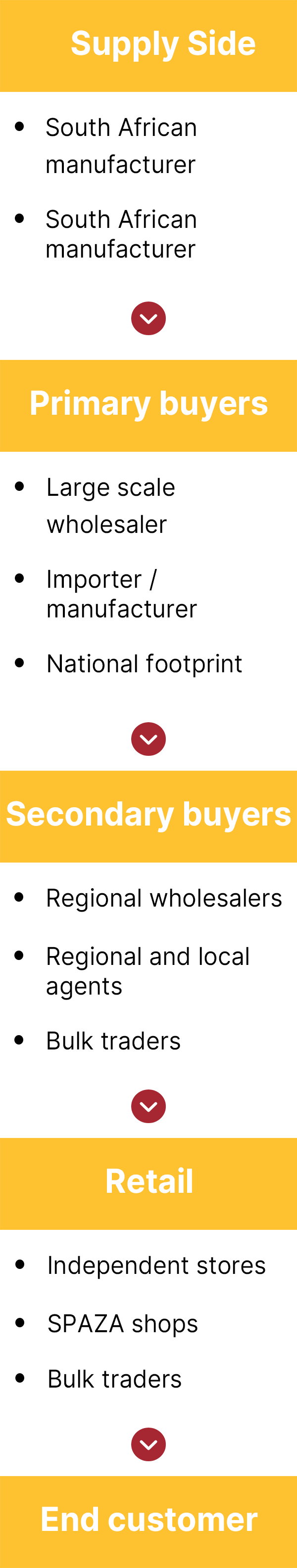

Due to the economic conditions of this segment, a majority of their spending on food and household products is done using cash from local independent stores, street traders and spaza shops. The township economy represents a significant opportunity for both manufacturers and importers of food and FMCG goods.

dmg events food, beverage and trade offerings, Africa’s Big 7 and SAITEX along with key stakeholders have developed an initiative to drive development, trade and inclusive growth in Southern Africa’s townships and informal economy by providing buyers and sellers with opportunities to access the township economy through our content, features, speakers and exhibiting opportunities.